The 3 Biggest Financial Mistakes Retirees Make When Buying a Home in Florida

Thinking about retiring in Florida? You’re not alone. Florida is one of the most popular destinations for retirees, offering warm weather, no state income tax, and incredible 55+ communities like those in Lakewood Ranch. But here’s the thing—not all moves go smoothly.

That’s exactly what we covered in today’s YouTube Live Stream at @941LifestyleGroup (catch us every Thursday at NOON EST! Subscribe here: YouTube.com/@941LifestyleGroup).

Buying a home—especially in retirement—is a huge decision. But too many retirees make the same costly mistakes. Let’s break down the top three financial mistakes retirees make when buying a home in Florida so you can avoid them.

1️⃣ Underestimating the Total Cost of Ownership

One of the biggest mistakes retirees make is focusing only on the home price. But there are hidden costs that can quickly add up, including:

✅ HOA Fees – These can range from $100 to over $1,000 per month depending on the community and amenities. Some HOAs cover just the basics (like landscaping), while others offer resort-style perks like pools, clubhouses, and security.

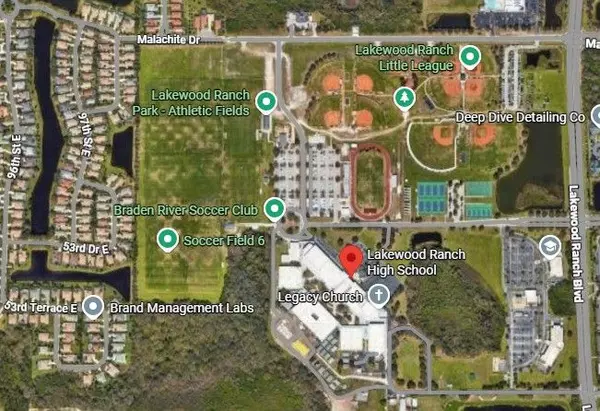

✅ CDD Fees – If you’re moving to a planned community like Lakewood Ranch, you might pay a Community Development District (CDD) fee. These fees go toward roads, parks, and amenities and are included in your property taxes each year.

✅ Property Taxes – While Florida has no state income tax, property tax rates vary by county and community. Some neighborhoods have additional taxes for schools, public services, or CDD fees.

✅ Homeowners Insurance – Florida’s weather means you’ll likely need hurricane and flood insurance, which can be significantly more expensive than in other states.

✅ Maintenance Costs – Roof repairs, AC units, landscaping, and exterior upkeep can add up. Some communities include these in HOA fees, while others leave them up to the homeowner.

What Does This Mean for You?

Make sure you budget beyond just the mortgage. Understand what’s included in your HOA, if there’s a CDD fee, and how much your property taxes will be. A home that seems affordable upfront can become a financial burden if you’re not prepared.

2️⃣ Not Timing the Market Correctly

Many retirees try to “time the market” to get the best deal. The problem? It rarely works. Here’s why:

👉 Waiting Too Long – Some buyers hold off, hoping for lower prices, but real estate values can rise while you wait. If mortgage rates drop in 2025, more buyers will flood the market, increasing competition and home prices.

👉 Buying at the Peak – Others buy during peak season (winter months in Florida), when demand is high, and prices are less negotiable.

👉 Market Shifts – Right now, homes in Lakewood Ranch are sitting longer, and many sellers are adjusting prices. Inventory is rising, and new construction incentives are making builder homes very appealing.

🏡 Looking for the best builder incentives? Check them out here: Lakewood Ranch New Home Incentives.

What Should You Do Instead?

If you’re serious about moving, the best time to buy is when you’re ready. The market will always fluctuate, but if you find a home you love and it fits your budget, go for it.

Pro Tip: Work with a real estate expert (👋 that’s us!) who understands the local market and can help you negotiate the best deal.

3️⃣ Overestimating How Much They’ll Use Certain Amenities

It’s easy to get swept up in the dream of resort-style living. But are you really going to use that golf course, clubhouse, or fitness center?

Many buyers pay high HOA fees for amenities they rarely use. Before choosing a home, ask yourself:

✔ What do I actually enjoy doing?

✔ Am I active enough to use a fitness center?

✔ Do I need a community with a golf course, or will I just play occasionally?

✔ Would I rather live in a lower-fee community and save the extra money?

💰 Real Example:

- Greenbrook Village (Low HOA, ~$100/month, parks but no fancy amenities).

- The Lake Club (Luxury amenities, over $9,000/year in HOA fees!).

What’s the Solution?

We specialize in Lifestyle Matchmaking. Instead of just selling homes, we help retirees find the perfect community based on their actual lifestyle.

If you’re not sure which community fits you best, let’s chat. We know every 55+ community in Lakewood Ranch and can help you find the perfect match.

📲 Get in Touch Here: Contact The 941 Lifestyle Group

Final Thoughts & What’s Next

Avoiding these three financial mistakes can save you thousands of dollars and help you find the perfect retirement home.

📌 Join Us LIVE Every Thursday at NOON EST

We go beyond just real estate and talk about everything related to retirement, lifestyle, and living in Florida.

💬 Drop a comment on our latest video and let us know: Where are you watching from?

📺 Subscribe here so you don’t miss the next one: YouTube.com/@941LifestyleGroup

🚀 Thinking about moving to a 55+ community in Lakewood Ranch? Let’s talk! We help retirees find not just homes—but the perfect lifestyle.

Beyond Homes - We Match Lifestyles

Sign Up To Receive Our Weekly Newsletter

Thank you for taking the time to read our blog. We are excited you found us.

We are the 941 Lifestyle Group.

We are real estate agents in Lakewood Ranch and would love to be your go-to real estate team in the 941 area.

We service all of Manatee and Sarasota Counties.

Specializing in Lifestyle Real Estate.

From the beautiful Gulf Beaches, Downtown Sarasota, and Lakewood Ranch.

Please reach out anytime.

941-233-9722

Adam Miller

Real Broker, LLC

*Some of our blogs were written with AI's assistance.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "