When Have Mortgage Rates and Home Prices Dropped at the Same Time? What It Means for Buyers and Sellers in 2025

When Have Mortgage Rates and Home Prices Dropped at the Same Time? What It Means for Buyers and Sellers in 2025

In today’s real estate market, one of the most common questions we hear at The 941 Lifestyle Group is:

"Have there ever been times when mortgage rates and home prices dropped at the same time?"

The short answer? Yes, but it’s rare.

Most of the time, mortgage rates and home prices move in opposite directions—when rates go down, demand increases and prices go up. But in some historical moments, both have declined together, often due to economic downturns or major financial crises.

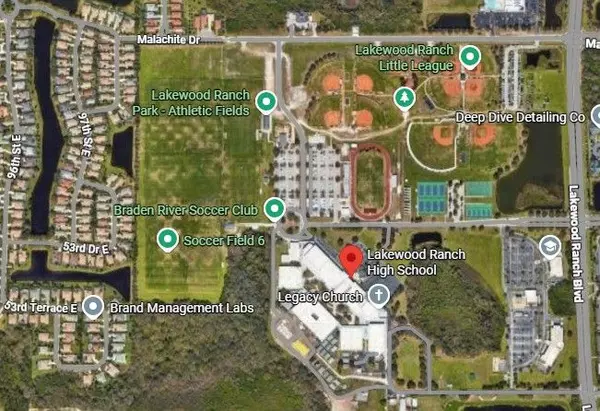

Understanding these past events can help homeowners looking to sell in 2025 and buyers wondering if now is a good time to enter the market. If you’re thinking about selling your home in Lakewood Ranch, or anywhere in the Sarasota-Bradenton area, we’ll break down what history tells us and how you can make informed decisions in today’s shifting market.

How Mortgage Rates and Home Prices Typically Move

To understand why it’s unusual for mortgage rates and home prices to drop simultaneously, let’s look at how they usually interact:

-

When mortgage rates drop:

- More buyers can afford homes.

- Demand increases.

- Home prices usually rise due to increased competition.

-

When mortgage rates rise:

- Buying power decreases.

- Fewer buyers enter the market.

- Home prices tend to stabilize or decline in response to lower demand.

However, there have been times when both mortgage rates and home prices have fallen together. Let’s dive into the most significant moments in history where this occurred and what caused it.

Historical Moments When Mortgage Rates and Home Prices Dropped Together

1. The Great Recession (2007–2012)

- Mortgage Rates: Fell from around 6.5% in 2007 to 3.31% by 2012 (a record low at the time).

- Home Prices: Dropped over 30% nationwide from peak to bottom.

What Happened?

The 2008 financial crisis was caused by a collapse in the housing market due to risky lending practices, subprime mortgages, and excessive speculation. When the bubble burst:

- Foreclosures skyrocketed.

- Home values plummeted as banks repossessed properties and sold them at deep discounts.

- The Federal Reserve slashed interest rates to stimulate the economy.

This was one of the only times in modern history when both mortgage rates and home prices dropped at the same time for an extended period.

What We Can Learn in 2025:

If a recession occurs, history suggests we could see mortgage rates fall as the Fed tries to stimulate the economy. However, home values wouldn’t necessarily crash unless demand drops significantly.

2. Early 1980s Recession & Recovery (1981–1983)

- Mortgage Rates: Peaked at 18% in 1981, then declined to 12% by 1983 as inflation was controlled.

- Home Prices: Declined in the early ‘80s due to high interest rates and economic struggles.

What Happened?

The Federal Reserve, led by Paul Volcker, aggressively raised interest rates in the late 1970s to combat inflation. This made borrowing incredibly expensive, causing:

- A deep recession.

- A slowdown in home buying.

- A drop in home prices in many parts of the U.S.

As inflation cooled, the Fed lowered rates, but the economy took time to recover, keeping home prices soft.

What We Can Learn in 2025:

If inflation remains under control and mortgage rates start to decline, home values could take time to adjust, depending on demand and the overall economy.

3. COVID-19 Market Shock (March–April 2020)

- Mortgage Rates: Fell to record lows (below 3%) as the Fed slashed rates.

- Home Prices: Temporarily declined in some markets before skyrocketing.

What Happened?

The uncertainty of the COVID-19 pandemic froze the housing market for a short time. However, once buyers realized rates were at all-time lows and inventory was scarce, demand soared, driving prices up instead of down.

What We Can Learn in 2025:

Even if mortgage rates drop significantly, it doesn’t always mean home prices will fall. Supply and demand remain the key factors.

Could Mortgage Rates and Home Prices Fall Together in 2025?

As we move through 2025, there’s growing speculation about where the market is heading. Will mortgage rates drop? Will home prices soften?

Here’s what to watch:

- Federal Reserve Policy – If the economy slows, the Fed may lower interest rates, leading to lower mortgage rates.

- Housing Inventory – If more homes come on the market, prices may soften.

- Buyer Demand – If buyers hesitate due to economic concerns, home prices could stabilize or decline.

What This Means for Sellers in 2025

If you’re thinking of selling your home in Lakewood Ranch, Del Webb, or the surrounding Sarasota area, here’s what you should consider:

- If mortgage rates drop, demand will increase – More buyers will be in the market, potentially driving up home prices.

- If economic conditions weaken, buyers may hesitate – Even if rates fall, if people feel uncertain about the economy, home prices could soften.

- Now may be the best time to sell – Inventory remains low, and buyers are still actively searching for homes in 55+ communities and luxury neighborhoods.

At The 941 Lifestyle Group, we specialize in matching your home with the right buyers—whether you’re selling a luxury home, a 55+ community home, or an investment property.

What This Means for Buyers in 2025

If you’re considering buying a home, Lakewood Ranch, Sarasota, and Manatee County remain some of the most desirable markets. Here’s what you should keep in mind:

- If mortgage rates drop, affordability improves – Locking in a lower rate means lower monthly payments.

- If home prices stabilize, opportunities increase – You may find better deals if sellers are motivated.

- Act early if rates drop – If rates fall, more buyers will enter the market, increasing competition.

At The 941 Lifestyle Group, we help buyers find the perfect home that matches their lifestyle—whether it’s a low-maintenance villa for snowbirds or a luxury estate in a gated community.

Final Thoughts: Is 2025 a Good Time to Buy or Sell?

While history shows that mortgage rates and home prices don’t usually drop at the same time, economic uncertainty can create unique opportunities for buyers and sellers.

- If you’re selling, now is the time to position your home effectively before competition increases.

- If you’re buying, keep an eye on mortgage rates, but don’t wait too long if you find the right home.

At The 941 Lifestyle Group, we go beyond homes—we match lifestyles. Whether selling a home in Del Webb Lakewood Ranch or looking for a luxury home in Sarasota, our expertise ensures you get the best deal in any market condition.

Are you thinking about buying or selling in 2025? Let’s talk. Contact us today to discuss your goals and how we can help you make the smartest move.

Beyond Homes - We Match Lifestyles

Sign Up To Receive Our Weekly Newsletter

Thank you for taking the time to read our blog. We are excited you found us.

We are the 941 Lifestyle Group.

We are real estate agents in Lakewood Ranch and would love to be your go-to real estate team in the 941 area.

We service all of Manatee and Sarasota Counties.

Specializing in Lifestyle Real Estate.

From the beautiful Gulf Beaches, Downtown Sarasota, and Lakewood Ranch.

Please reach out anytime.

941-233-9722

Adam Miller

Real Broker, LLC

*Some of our blogs were written with AI's assistance.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "